The Securities and Exchange Board of India (Sebi) is investigating possible insider trading by senior officials of IndusInd Bank, which earlier this month announced large derivative losses, said two people close to the development.

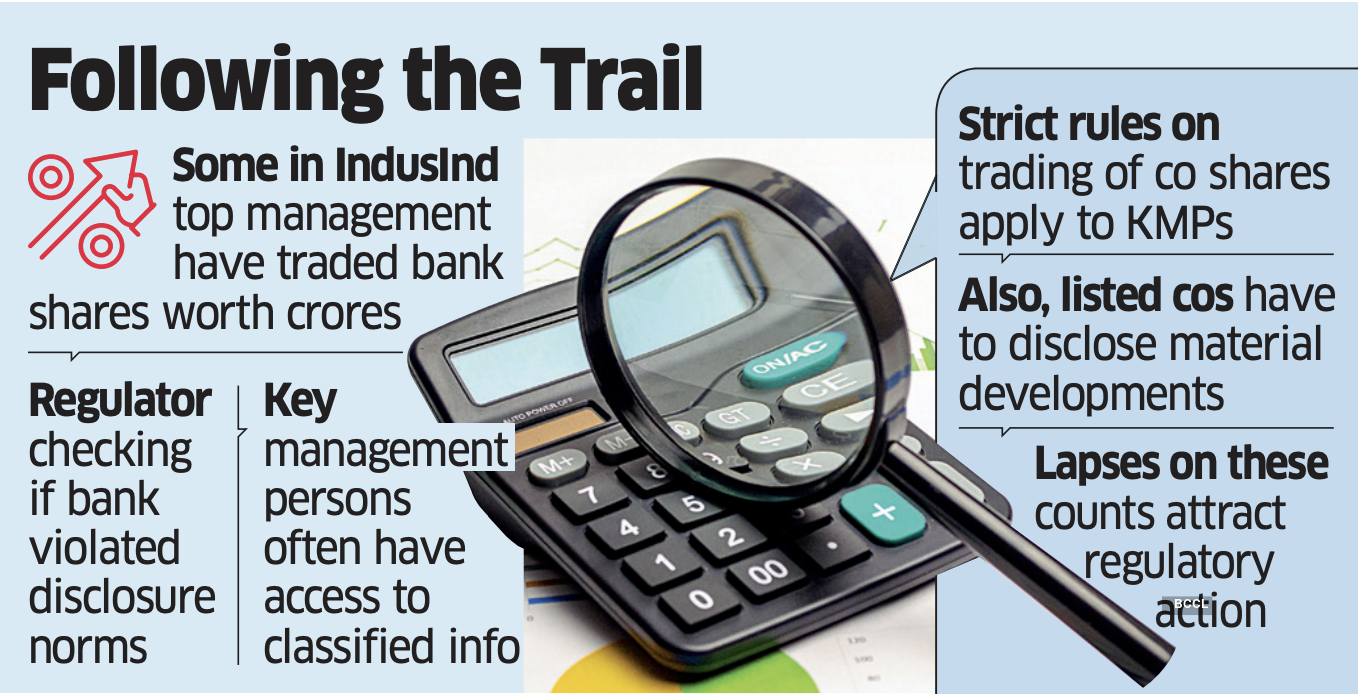

The regulator has sought information from the private lender about the trades executed by five senior bank officials while they were in possession of unpublished price-sensitive information. It is also examining whether the bank violated its disclosure norms, said one of the people. According to disclosures made to stock exchanges, some top management personnel sold and bought bank shares worth crores of rupees since January 2024. “As KMPs (key managerial personnel), if they knew about the central bank’s action, or the action it could take, they can’t trade, even if it involves encashing ESOPs (employee stock ownership),” said the person cited.

Sebi and IndusInd Bank didn’t respond to queries from ET.

IndusInd Bank’s ₹1,500-crore derivative losses owe their origin to a September 2023 directive from the Reserve Bank of India, laying down that all derivative transactions have to be marked-to-market, that is, valuing the instruments according to their current market prices.

Stock Sank after Late Disclosure

Since IndusInd followed a dual accounting policy, the losses linked to existing derivative deals had to be accounted for. However, the bank informed stock exchanges about the possible impact on its balance sheet almost 15 months after the regulatory communique.

On March 10, the seventh largest private lender by market capitalisation told the exchanges it had underestimated hedging costs with respect to some past foreign exchange transactions – which had an adverse impact of about 2.35% in its net worth as of December 2024 – without providing further details.

On March 11, the stock dropped 27% to close at Rs 656 on the BSE.

On March 7, the bank disclosed that the Reserve Bank of India had extended the term of chief executive Sumant Kathpalia for a year, as against three years sought by the board.

IndusInd Bank chief financial officer Gobind Jain had resigned in January after serving over three years.

“KMPs must exercise utmost caution while dealing with unpublished price-sensitive information,” said Pavan Kumar, founder of Corporate Professionals, an advisory group. “Sebi regulations clearly prohibit them from trading based on such information, or passing it to anyone else. They are equally responsible for ensuring their portfolio managers and immediate relatives do not trade during this period.”

Kumar added that in cases where KMPs are in constant possession of unpublished price-sensitive information due to the nature of their role, Sebi allows them to submit a predefined trading plan. This plan must be drawn up in advance, specifying the trades to be executed.

Once approved, trades can only be carried out in accordance with this plan, and the KMP is bound to strictly follow it. Any deviation or misuse can attract regulatory action, making compliance non-negotiable.